22 July 2021 | 19 August 2021

I wrote an article in 2018 that focused on positioning blockchain as an integral part of the digital transformation journey and connecting value chains. While some of the technological, regulatory, and standardization challenges surrounding distributed ledger technologies are yet to be addressed, organizations around the globe are digitizing their assets at a rapid rate as blockchain use cases flourish and they seek to disrupt existing business paradigms. In some sectors, large-scale institutions are finding new ways to orchestrate transactions through global partnerships, leading to a notable increase in the adoption of #smart contracts.

Post-COVID, public-private collaborations are accelerating investments in blockchain technology, giving rise to new business models for decentralized networks. As an example, the fintech space has seen major investments in thematic sandboxes geared towards innovation in digital identity management, Know Your Customers (KYC), risk and compliance, cross-border payments, remittance, exchanges, insurance, internet banking, trade finance, etc. This increased adoption of blockchain technology will in turn create demand for more services to manage the networks, infrastructure, and data security standards across inter-connected industries.

This brief article shines a spotlight on smart contracts as enablers for the decentralized enterprise value chain and invites you to join our executive webinar series on 22nd July and 19th August.

The Challenge

A smart contract is a self-executing programmable contract with terms of an agreement between parties that can be implemented as code to execute business logic in response to business events. The code leverages blockchain technology to create a decentralized ledger and is used to orchestrate transactions while making them auditable and immutable.

Smart contracts can be used to verify, calculate, and schedule a task, then automatically carry out the task when certain conditions are met – this saves time, eliminates inefficient cost centers, and enables multi-party consensus-based validation. Given this critical role, designing a smart contract requires a secure architecture approach from the ground up as the cost of failure in certain financial transactions can be extremely high, particularly as the finite block space and increasing on-chain activity drives up the cost of computational resources. Although architectural patterns exist, the lack of global standards and regulations over smart contracts and blockchain, in general, are among the key reasons why the universal adoption of distributed ledger technologies has been slow in certain highly regulated industries.

Real-world examples of blockchain innovation

As highlighted above, shifting businesses from a human-centric trust model to an algorithm-centric trust model is not an easy undertaking, and coupled with the relatively early maturity level of blockchain technology, gaining consortia participation in your blockchain network is fraught with challenges. But many organizations in finance, insurance, healthcare, government, media, and other sectors are taking part in blockchain proof of concept projects across the globe and some have successfully deployed live blockchain networks over the last few years. The team at Eastnets has a deep understanding of blockchain use cases for fintech innovation, as demonstrated by #ChainFeed which was developed in partnership with #Dow Jones Risk & Compliance. Today, all financial institutions who are actively using Eastnets SafeWatch have access to Dow Jones's high-quality sanction alerts carried over a private blockchain network directly to the screening engine, Eastnets SafeWatch Filtering.

Building sustainable fintech models

In a globally interconnected financial ecosystem where the window for real-time payments and instant settlement are measured in under 10 seconds and shrinking every day, RegTech innovation and fighting financial crime requires a broad set of capabilities. As financial service digital transformation initiatives lead to greater levels of data sharing and digital interaction, the importance of interoperability cannot be over-stated. Blockchain innovation in key areas such as reconciliation, settlement optimization, compliance, and suitability requires an E2E view of the transaction lifecycle and value chain to ensure the products are secure and frictionless.

But as is often the case with implementing technologies in the early maturity phase, organizations need to implement rigorous risk management strategies, standards, governance, and control frameworks. The challenge is exacerbated by the elevated complexity of cybersecurity threats to the enterprise where zero trust adoption is no longer an option, and advances in quantum computing represent both threats and opportunities for the future of blockchain networks.

So how can organizations innovate in today’s ultra-competitive global financial ecosystem that is rapidly shifting towards decentralized business models, driven by the smart contract economy? And what are the architectural, security, technological, and policy considerations to help future-proof your business?

TIBCO & Eastnets Meetup Series: 22nd July and 19th Aug

- On Thursday 22nd July, our AI, Blockchain, RPA & QC Meetup Network is proud to be hosting Nelson Petracek (Chief Technology Officer, TIBCO Software Inc.) for an interactive discussion on how businesses are achieving the level of agility needed to succeed in an increasingly connected world by building “digital twins” – digital representations of devices and equipment, but also of business processes, people, and even the organization itself. Hear how blockchain, in conjunction with smart contracts, can drive the next generation of digital twin applications.

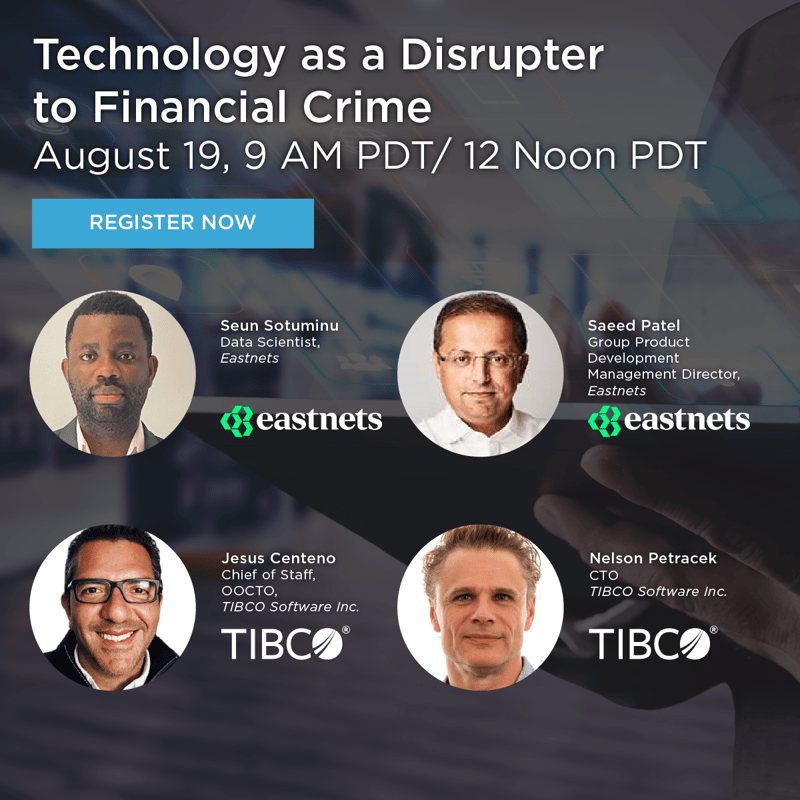

- On Thursday 19th August, we’ll delve deeper into blockchain innovation with a top panel where Nelson will be joined by Saeed Patel (Group Product Development Management Director, Eastnets), Seun Sotominu (Data Scientist, Eastnets), and Jesus Centeno (Chief of Staff, OOCTO, TIBCO Software Inc.) as moderator. The panel will discuss how real-time compliance risk solutions in AML and KYC encompassing AI and blockchain technologies are at the frontier of combating financial crime. They will also explore collaborative intelligence solutions where human and machine learning plays a pivotal role in the detection and reporting of suspicious transactions, identify anomalous behavior and help to reduce AML false positives.

Register for the free webinars below

Thursday, July 22nd event: Blockchain: Powering Next-generation Digital Twins

Thursday, August 19, 2021 - Technology as a disrupter to financial crime