How American Express KSA streamlined compliance and reduced false positives with SafeWatch Screening 5

- Resources

- Case studies

- How American Express KSA streamlined compliance and reduced false positives with SafeWatch Screening 5

Situation

Processing large volumes of financial traffic daily

American Express KSA offers a range of credit and charge cards for Individuals and corporates, processing large volumes of internal and external financial traffic daily.

To comply with financial regulations, including Anti-Money Laundering requirements, AMEX team needed a powerful solution capable of real-time blocking and batch screening. Additionally, they sought to control false positives to align with their institutional risk appetite while maintaining compliance with evolving regulatory demands.

Task

Centralized screening solution

American Express KSA aimed to implement a centralized screening solution that could address stringent AML requirements while maintaining acceptable levels of false positives. The growing scrutiny from regulatory bodies on monitoring systems highlighted the need for a more intelligent and efficient mechanism that could meet compliance standards as regulations continued to evolve.

Action

Eastnets action plan

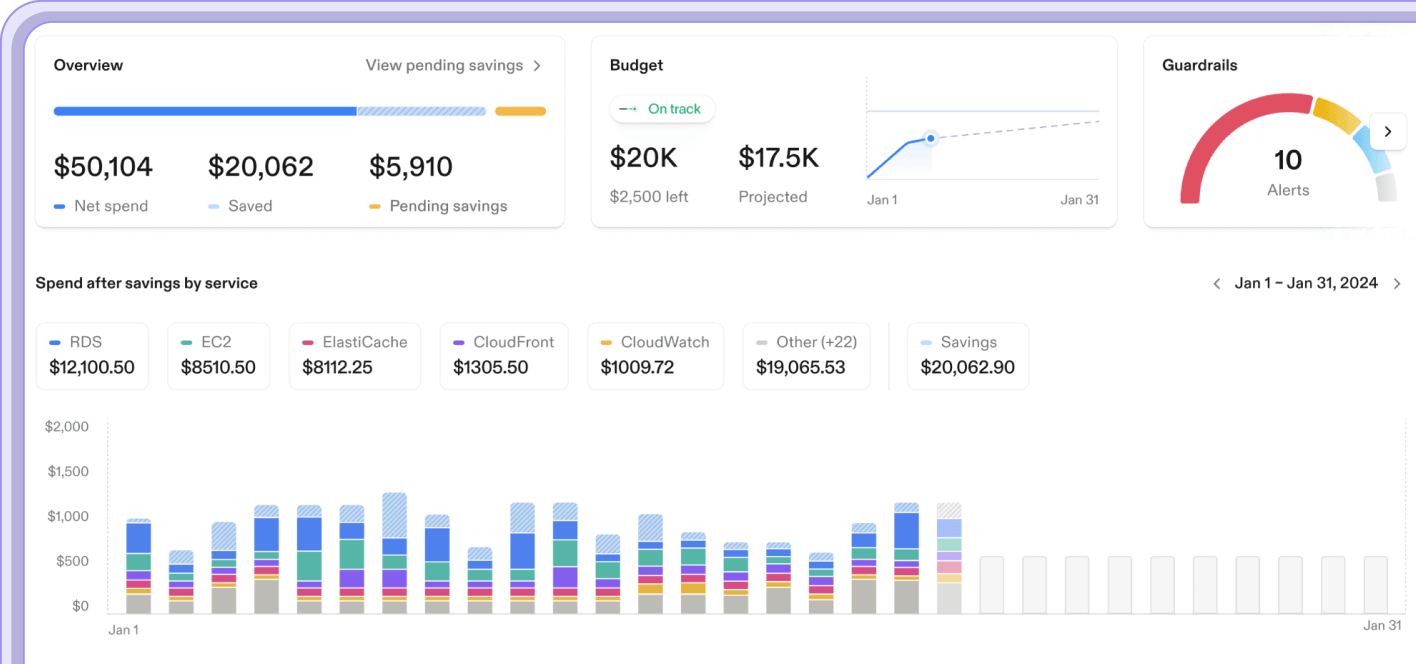

Eastnets implemented SafeWatch Screening 5 as the core solution for AMEX to fulfill the screening requirement. The solution facilitated seamless integration via REST APIs with their onboarding systems within a microservices architecture, enabling efficient real-time name screening for new clients.

-

SafeWatch Screening

Provided a centralized checkpoint for all financial traffic while leveraging advanced false positives reduction mechanisms. The solution also streamlined compliance with auditing and reporting requirements, offering operational efficiency through comprehensive reporting and data archiving.

-

To maintain ongoing regulatory compliance and performance optimization, the system is regularly updating the public lists such as OFAC and EU public lists and tuned to balance the reduction of false positives without compromising on detecting critical threats.

Results

SafeWatch Screening implementation

The SafeWatch Screening implementation has significantly enhanced American Express KSA’s monitoring processes by centralizing financial traffic alerts into a unified interface for compliance officers.

90%

reduced false positives with the advanced filtering techniques

Regular system tuning

enabled American Express KSA to stay compliant while boosting the effectiveness of their screening operations.

Products used

SafeWatch Screening

The next products in your Anti Money Laundering journey

Eastnets products are toolsets designed to work together for maximum protection and security. Stacking our products into a modular solution that fits your exact needs is highly recommended to reduce financial crime, fraud and other nefarious acts that could compromise your network.

Arrange a demo

Our fraud and compliance experts are ready to help build you a custom solution. Book a demo with our team today and start your journey to compliance bliss.