Real-Time IBAN & Payee Details Verification

Verify payee details and IBANs in real-time— 24/7/365 — for outbound payments, meeting strict security requirements.

Single integration for payee account validation to prevent fraud, errors, and misdirected payments—delivered in real time, across borders.

Streamline fraud controls worldwide with Eastnets’ COP—light-touch deployment, live in just weeks.

Verify payee details in seconds, anytime and anywhere, while meeting strict security standards.

Deploy payee verification in weeks with pre-defined workflows and a single API integration.

Use advanced matching algorithms to automatically resolve close-match cases.

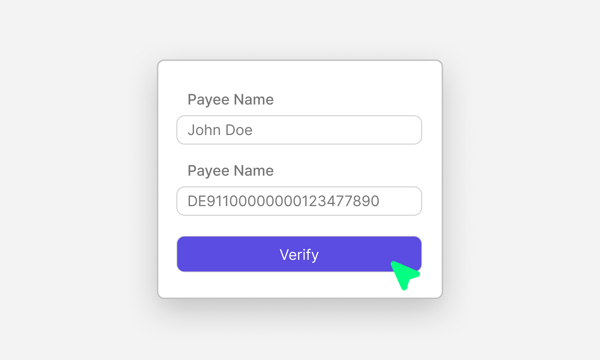

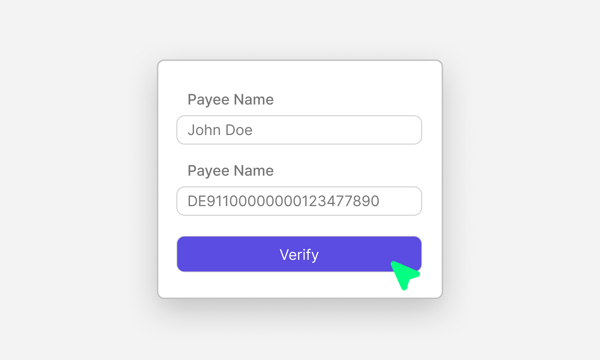

Intuitive interface for single or bulk payee verification.

Centralized connection to payee data sources with ongoing API maintenance.

Reduce costs with a managed service in private or public cloud, backed by 24/7 support.

Eastnets’ Confirmation of Payee (COP) Service enables instant, real-time account validation—ensuring secure, compliant, and error-free payments across domestic and cross-border transactions.

Verify payee details and IBANs in real-time— 24/7/365 — for outbound payments, meeting strict security requirements.

Integrate with any payee’s data provider or scheme in just weeks through a single API, using built-in adapters or API configuration. Leverage Eastnets’ lightweight, zero-code orchestration module with pre-defined CoP flows to secure cross-border, regional, and domestic payments.

Access centrally through a single API a list of pre-defined data providers per country corridors with peace of mind (benefit from continuous API maintenance and backwards compatibility).

Leverage advanced matching algorithms to detect mismatches, typos, abbreviations, and diacritics, reduce unmatched cases and resolve close match cases automatically, with increased accuracy.

Monitor COP fraud controls in real time with intuitive dashboards, track performance across flows, report on KPIs and SLAs, and continuously improve response times and fraud detection effectiveness.

Easily run single or bulk checks via a modern, intuitive UI.

Choose the setup that fits your infrastructure, deploy fully managed COP services in the private or public cloud or within your own environment, backed by 24/7 support operations.

Whether mandated by regulations or guided by internal risk policies, adopt a holistic CoP solution that works seamlessly with your fraud controls—preventing payment errors, enabling growth, and elevating the customer experience across every financial flow.

Build customer trust and loyalty with a comprehensive CoP service that unites regulatory compliance and operational efficiency, seamlessly integrated into your existing platform.

Stay ahead of fraud and the competition with built-in CoP protection. Minimize integration costs by combining CoP controls with your fraud monitoring tools.

Protect global payment operations and stop misdirected payments with Eastnets’ advanced risk controls, combining real-time fraud detection and Confirmation of Payee before instructions reach your financial institution.

Discover how real-time confirmation of payee helps you meet prevent fraud, and avoid misdirected payments, all with efficiency and peace of mind.

PaymentSafe underpins Eastnets’ CoP solution as a secure, scalable orchestrator, relied on by 120+ financial institutions. With zero-code integration, it streamlines API and manual workflows, enhanced by advanced matching and intelligent routing.

PaymentSafe delivers real-time risk monitoring capabilities that integrate seamlessly within your existing applications for fraud detection and monitoring as part of a comprehensive platform.

COP refers to the process of verifying payee details before a transaction is initiated, ensuring that payments reach the intended recipient accurately and securely. This helps businesses prevent fraud and reduce misdirected payments.

Incorrect or fraudulent payee details can lead to payment failures, financial losses, and compliance issues. Validating payee information in real time helps financial institutions, PSPs, and businesses reduce fraud risks, improve transaction accuracy, and enhance customer trust.

Eastnets COP is a real-time, cross-border payee verification solution that confirms the match between the beneficiary’s name and IBAN before a’s payment is made—reducing fraud, errors, and operational risks.

Yes, SWIFT Pre-validation is supported as part of the Eastnets COP solution. It can be seamlessly accessed through the same single API, allowing financial institutions to validate beneficiary details using SWIFT’s global data alongside other verification sources.

Eastnets COP comes with built-in workflows, powered by our lightweight PaymentSafe orchestrator. With expert-led configuration and dynamic API integration, deployment can be completed in a few weeks, helping you meet compliance deadlines quickly and with minimal disruption to your existing infrastructure.

Contact an Eastnets expert to learn more about our COP solution or schedule a product demo.

Comprehensive solutions that safeguard your business and tackle regulatory requirements.

Enables institutions to monitor transactions, investigate suspicious activities, and generate regulatory reports, reducing false positives and enhancing decision-making.

By offering advanced behavioral analytics and flexible rule-creation, SafeWatch AML aligns with firms seeking a more modern, tech-driven approach to financial crime prevention.

Dynamically detect and stop fraudulent payments utilizing AI, machine learning, and pattern recognition.

Speak with an expert to explore more products and options to suit your needs.