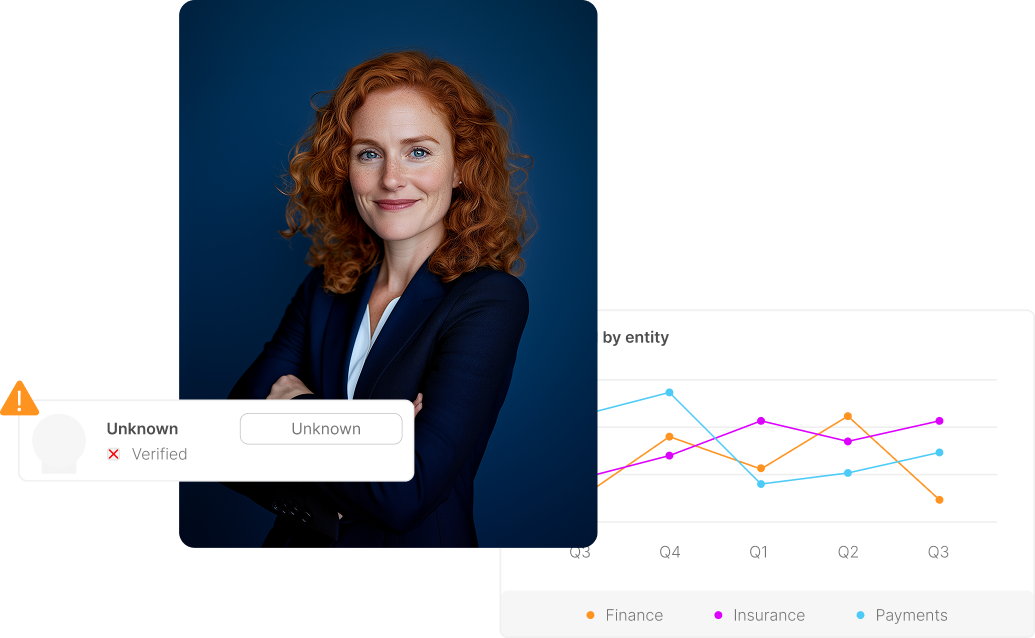

Automate customer screening

Quickly and easily screen customers against national and international watchlists, for both new and existing customers.

SafeWatch KYC streamlines customer onboarding, automates due diligence, and continuously monitors customer risk—so you maintain confidence in customer identity and risk status, while staying compliant and reducing operational complexity.

As regulations tighten and customer expectations rise, outdated manual processes and static risk assessments no longer suffice. SafeWatch KYC delivers automated, intelligent due diligence that adapts to every stage of the customer lifecycle.

Reduce time and resources spent on manual form handling and verification.

Screen customers against global watchlists and apply dynamic risk scoring from day one.

Streamlined workflows and automated escalation reduce bottlenecks and improve turnaround time.

Continuously updated scoring ensures customer profiles reflect current risk levels.

Easily adapt forms, workflows, and rules to meet changing regulatory requirements.

SafeWatch KYC ensures you know everything you need to know about your customers, protecting you from unwanted risk and exposure with proactive customer due diligence. Our dynamic scoring methodologies assess risk for a more streamlined due diligence process that reduces the amount of time needed for onboarding and monitoring. With fewer manual processes, you’ll reduce operational costs while improving risk detection with dynamic risk scoring and intelligent analytics.

It can also be difficult to ensure compliance with tightly regulated KYC standards, which is why SafeWatch KYC includes continuous compliance monitoring, to ensure you’re always in line with new local and international regulations.

Quickly and easily screen customers against national and international watchlists, for both new and existing customers.

SafeWatch KYC constantly monitors customer activity patterns to detect and mitigate emerging customer risks before they become an issue.

Advanced analytics deliver real-time, accurate risk profiling—supported by UBO data, digital onboarding integrations, and perpetual KYC monitoring—to help you identify emerging risks early and act with confidence.

SafeWatch KYC is easy to integrate with your existing customer management systems and onboarding platforms, meaning you can share data for a more comprehensive solution.

“The deployment of the KYC and AML platform has delivered significant operational efficiencies and enhanced our regulatory compliance posture. The elimination of manual forms and the implementation of a robust AML system, aligned with SAMA requirements, have been key benefits. The comprehensive training program effectively equipped our team for optimal utilization, leading to a successful transition and positive results"

Compliance Team, Gulf Insurance Group (GIG) KSA

KYC regulations are complex and ever changing. That’s why SafeWatch KYC is aligned with global regulations including AMLD, FATF and OFAC. The system automatically updates regulatory requirements so you’ll always be aligned with changing compliance requirements, and with no manual input needed.

SafeWatch KYC generates detailed documentation, with a customisable workflow that allows you to tailor it to suit your organisation’s data capturing and recording workflow.

Eastnets products are toolsets designed to work together for maximum protection and security. Stacking our products into a modular solution that fits your exact needs is highly recommended to reduce financial crime, fraud and other nefarious acts that could compromise your network.