Real-Time IBAN & Payee Details Verification

Verify payee details and IBANs in under 5 seconds — 24/7/365 — for both inbound and outbound flows, meeting IPR and EPC SLA requirements with ease.

Easily integrate Eastnets’ Qualified Routing and Verification Mechanism (RVM) into your current systems to meet EU Verification of Payee (VOP) requirements and stay aligned with the EPC scheme for SEPA Credit Transfers, all in real time.

Streamline VOP fraud controls across all SEPA payment flows with a light-touch deployment of Eastnets’ EPC-qualified RVM, live in just a few days.

Deliver real-time, secure Verification of Payee in under 5 seconds, operating 24/7/365, fully aligned with EC IPR SLAs and eIDAS security standards.

Fast-track your compliance with EU VOP regulations through a streamlined onboarding process and back-office integration completed in just 4 weeks.

Minimize false positives with advanced, EPC-compliant matching algorithms, reducing close match cases and improving operational efficiency.

Lower operational overhead with a fully managed service available in both private and public cloud environments, backed by 24/7 support.

Stay future-proof with continuous scheme update management to maintain VOP and EDS compliance.

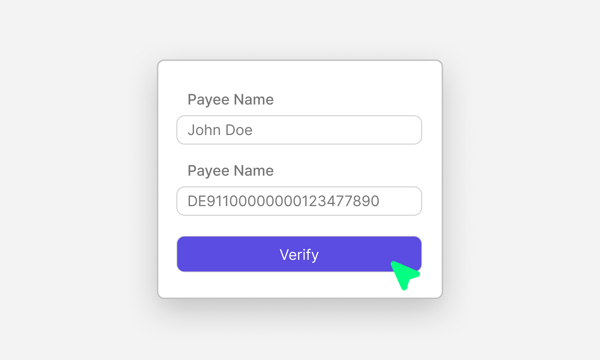

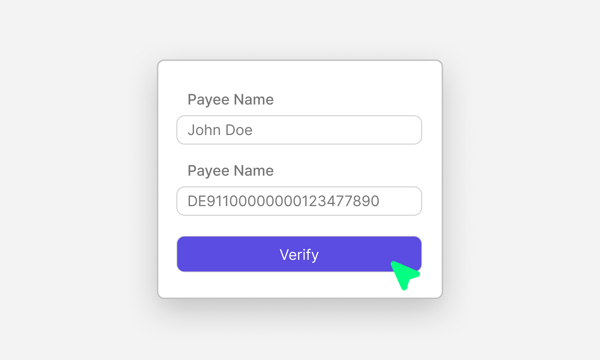

Leverage intuitive manual VOP checks for both single and bulk data submissions when needed.

Real-time Verification of Payee through a Qualified RVM, delivering fast, compliant, and reliable validation of SEPA payee details anytime, anywhere.

Verify payee details and IBANs in under 5 seconds — 24/7/365 — for both inbound and outbound flows, meeting IPR and EPC SLA requirements with ease.

Leverage proven advanced algorithms to detect mismatches, typos, abbreviations, and diacritics, all while staying fully compliant with EPC matching logic.

Launch VOP services in just weeks with lightweight, zero-code orchestration across all SEPA payment flows and channels, fully integrated with EPC VOP APIs and no disruption to your existing infrastructure. payment infrastructure.

Monitor VOP fraud controls in real time with intuitive dashboards, track performance across incoming and outgoing flows, report on KPIs and SLAs, and continuously improve response times and fraud detection effectiveness.

Leverage intuitive manual user interface for both single and bulk verification of payee information.

Choose the setup that fits your infrastructure, deploy VOP securely in the cloud or within your own environment to meet internal and regulatory requirements.

Whether driven by EU regulations or internal risk policies, adopt a comprehensive VOP solution that integrates seamlessly with broader fraud controls, helping you prevent payment errors, support growth, and enhance the customer experience across all financial flows.

Strengthen customer trust and loyalty with a comprehensive VOP service that combines regulatory compliance with operational efficiency , seamlessly integrating into your existing platform.

Stay ahead of fraud and competition with your built-in VOP protection. Reduce investment in standalone controls with integrated fraud monitoring tools that seamlessly embed into your existing products.

Safeguard global payment operations and cut the cost of misdirected payments with advanced risk controls, including real-time fraud detection and VOP services applied before payment instructions reach your financial institutions.

Discover how real-time varifiction of payee helps you meet EU compliance requirements, prevent fraud, and avoid misdirected payments, all in one comprehensive guide.

Eastnets’ VOP solution is built on PaymentSafe, our secure, scalable, and lightweight orchestrator trusted by over 120 financial institutions worldwide.Designed for rapid, zero-code integration, it supports both API and manual workflows with advanced matching and intelligent routing.

More than just a compliance tool, PaymentSafe delivers real-time risk monitoring as part of a comprehensive and future-ready platform.

Eastnets PaymentSafe enables full compliance with the latest EU fraud detection mandates and internal risk policies, making regulatory adherence simple, reliable, and future-ready.

Eastnets’ VOP solution is fully aligned with the EU Instant Payments Regulation (IPR), requiring financial institutions to offer payee and IBAN verification for all SEPA Credit Transfers — instant or not — across all channels. We ensure full compliance with IPR deadlines and SLA response times, while adhering to the EPC VOP Scheme requirements, including request/response APIs, matching logic, security protocols, and integration with EPC Directory Services (EDS).

Generate structured logs and tailored reports with ease. Eastnets’ VOP solution supports internal risk monitoring and regulatory reporting with transparent performance metrics, enabling you to track SLAs, demonstrate compliance, and provide clear documentation for audits or fraud reviews.

PaymentSafe is built to evolve, continuously updated to meet new regulatory and industry requirements in the fight against financial crime. It provides the assurance and predictability you need to stay compliant with changing regulations and scheme updates, ensuring long-term fraud detection and financial security.

All PSPs operating in the Eurozone must comply by October 9, 2025, with additional deadlines for non-euro EU countries and EMIs by 2027.

Eastnets is a Qualified Routing and Verification Mechanism (RVM), offering a fully managed, EPC-aligned VOP solution that verifies payee details in real time. Easily integrate it into your existing infrastructure within weeks and stay compliant with evolving EU regulations.

Beyond standard EPC VOP matching, Eastnets enhances payee verification with advanced matching logic and configurable fraud controls at every stage of the payment process. Backed by our secure, future-ready PaymentSafe platform, the solution offers flexible deployment (cloud or on-premises), supports both single and bulk checks, and integrates seamlessly with zero code, delivering unmatched adaptability and performance.

Eastnets VOP comes with built-in workflows for the EPC scheme, powered by our lightweight PaymentSafe orchestrator. With expert-led configuration and dynamic API integration, deployment can be completed in a few weeks, helping you meet compliance deadlines quickly and with minimal disruption to your existing infrastructure.

Contact an Eastnets expert to learn more about our Verification of Payee (VOP) solutions or schedule a product demo.

Comprehensive solutions that safeguard your business and tackle regulatory requirements.

Enables institutions to monitor transactions, investigate suspicious activities, and generate regulatory reports, reducing false positives and enhancing decision-making.

By offering advanced behavioral analytics and flexible rule-creation, SafeWatch AML aligns with firms seeking a more modern, tech-driven approach to financial crime prevention.

Dynamically detect and stop fraudulent payments utilizing AI, machine learning, and pattern recognition.

Speak with an expert to explore more products and options to suit your needs.