Redefine Sanctions Detection with AI

Our AI‑powered sanctions and watchlist screening platform helps financial institutions replace outdated systems with a faster, smarter, more accurate way to detect risk — without heavy services or disruptive upgrades.

Trusted by institutions who need screening that performs

Real numbers. Real impact. Real compliance transformation. These results aren’t pilots or prototypes — they’re production deployments used by investigators every single day.

Reduce false positives with AI

Sohar International reduced alerts from 312,000 → 102,000 through precision tuning and AI‑powered optimization.

500% fewer false alerts

Al Jazeera Finance achieved a dramatic 5× reduction in false‑positive detections, boosting team efficiency instantly.

24/7 real‑time processing

Banque Banorient France unlocked instant payments readiness with full ISO 20022 alignment and uninterrupted operations.How SafeWatch Screening 5.0 Elevated Mastercard’s Compliance Efficiency

The migration to SafeWatch Screening 5.0 delivered clear, measurable improvements across Mastercard’s compliance operations:

Enhanced Detection Accuracy

Advanced algorithms reduced false positives and improved decision-making precision.

Real-Time Processing

Instant, high-volume transaction screening maintained compliance without slowing down payments.

Regulatory Confidence

SafeWatch Screening 5.0 positioned Mastercard to exceed global AML and financial crime prevention standards.

Ramy Mansour, Vice President Legal Compliance Mastercard Transaction Services EU

Who this solution is for

You're looking for something clearer, smarter, and easier than what you use today and exploring how to modernize your sanctions watchlist screening

Whether you're evaluating options or beginning a full replacement journey, this page gives you a clear, modern view of what screening should look like today.

-

For Compliance Leaders

If you’re driving regulatory alignment, reducing risk exposure, or modernizing controls, this platform shows what’s possible with AI‑powered detection.

-

For AML & Financial Crime Teams

If you're tired of noisy alerts, slow investigations, or outdated tools, you’ll see how investigators regain time — and accuracy.

-

For Banks, Fintechs & PSPs

If you're scaling operations, preparing for instant payments, or replacing outdated screening, this is the future‑ready alternative built for you.

Move beyond outdated, high false positive systems

If you rely on an obsolete screening tool today, you are not alone. Many institutions are looking for a simpler, faster way to stay compliant without being held back by technology.

Pain points with old systems

- Costly upgrades that wipe previous configurations

- Leasing model driving higher TCO

- Long, professional‑services‑heavy implementations

- Disruption during version migrations

Our AI powered and agile screening alternative

- Modular architecture with no code policies and workflows

- Multiple connectors and integrations with API connectivity

- Faster deployments, time to market and a lower TCO

- Increased alerts and notifications in real time

See how AI is redefining financial crime prevention

Hear from our Head of AI on how machine learning uncovers behavioural anomalies and sanctions‑evasion patterns in real time.

Chosen by 800+ leading financial institutions in 100+ countries

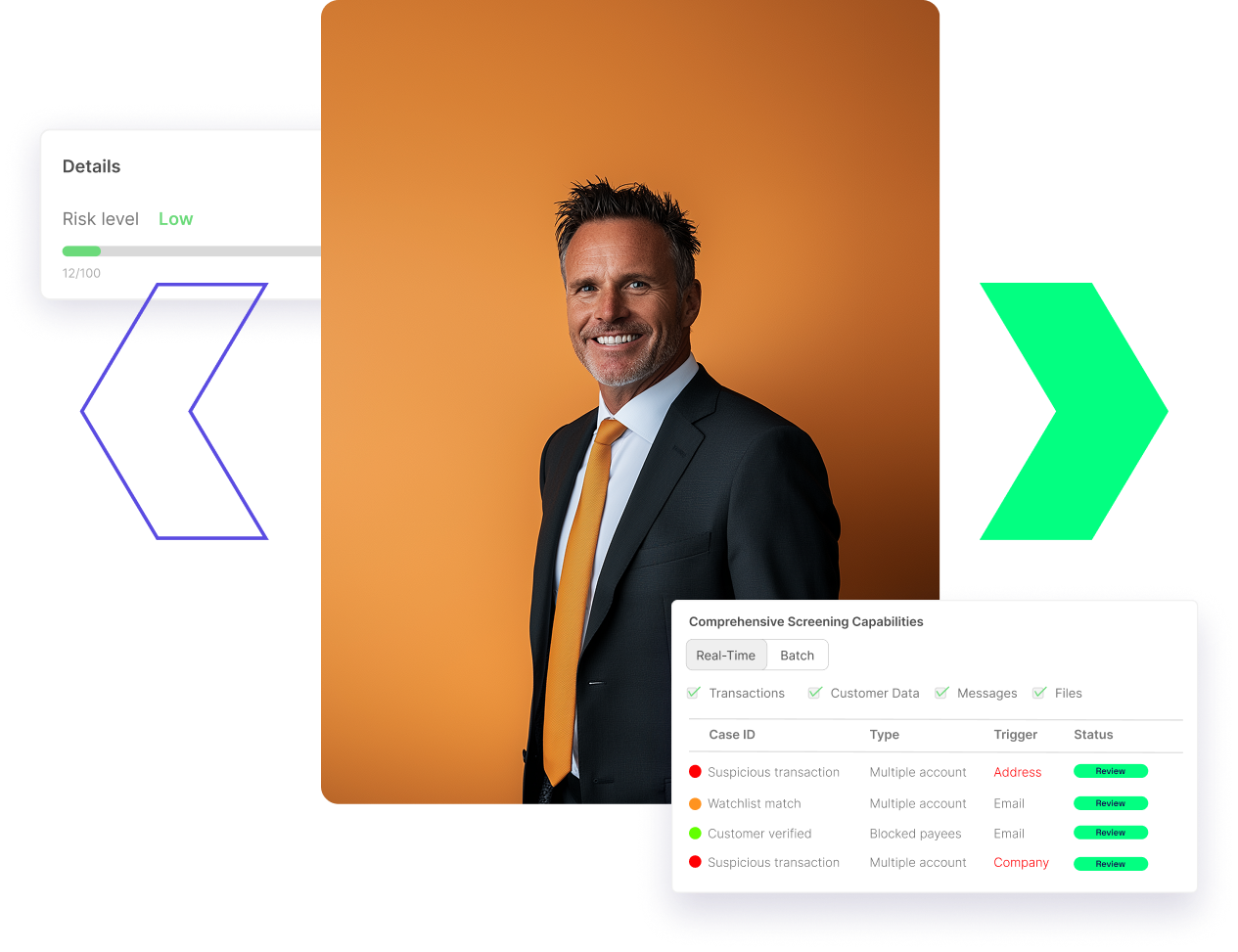

What our screening platform can do

These are the core capabilities of our AI‑powered screening platform — built to strengthen sanctions and watchlist compliance while reducing operational load.

Name Screening

Batch, real‑time, and continuous screening across customers and entities.

Transaction Screening

Real‑time monitoring with advanced detection logic including repeats and FATF 16.

AI Intelligence

Explainable AI for alert prioritization, noise reduction, and continuous learning.

No‑Code Policy Engine

Adapt matching rules, thresholds, and workflows without vendor reliance.

Investigator‑First UX

Clear, intuitive investigations experience designed to speed decision‑making.

Multi‑Network Support

Screen across SWIFT, domestic payments, RTP/Instant, and internal systems.

Performance Architecture

Built for scalability, high availability, and seamless upgrades without disruptions.

Regulatory Alignment

Continuously updated to support evolving regulatory and market requirements.

Download the SafeWatch Screening 5.0 FactSheet

Learn how SafeWatch Screening 5.0 improves detection accuracy, reduces false positives, and simplifies compliance with a smarter, faster platform. Download the fact sheet to explore key features and upgrades.

Contact us and see our SafeWatch Screening solution in action

Discover how our AI-powered sanctions screening reduces false positives and speeds up investigations.

A recognised leader in financial software