Streamlining Operations and Mitigating Financial Losses (Duplicate Detection)

- Resources

- Case studies

- Streamlining Operations and Mitigating Financial Losses (Duplicate Detection)

Situation

Challenges of duplicate transactions

Eastnets and four prominent tier-1 financial institutions embarked on a collaborative journey to address the challenges of duplicate transactions found throughout their internal processes.

Eastnets’ custom messaging duplicate detection system brought significant benefits to the institutions, including risk prevention, cost reduction, improved operational efficiency and an enhanced customer experience.

Background

The cornerstone for financial stability in this region, the four esteemed tier-1 financial institutions specialise in Private Banking, Corporate and Investment Banking and Wealth and Investment.

It’s crucial for these institutions to continuously evolve and stay at the forefront of the ever-changing financial market, ensuring trust and setting the benchmark for excellence in the financial industry.

Action

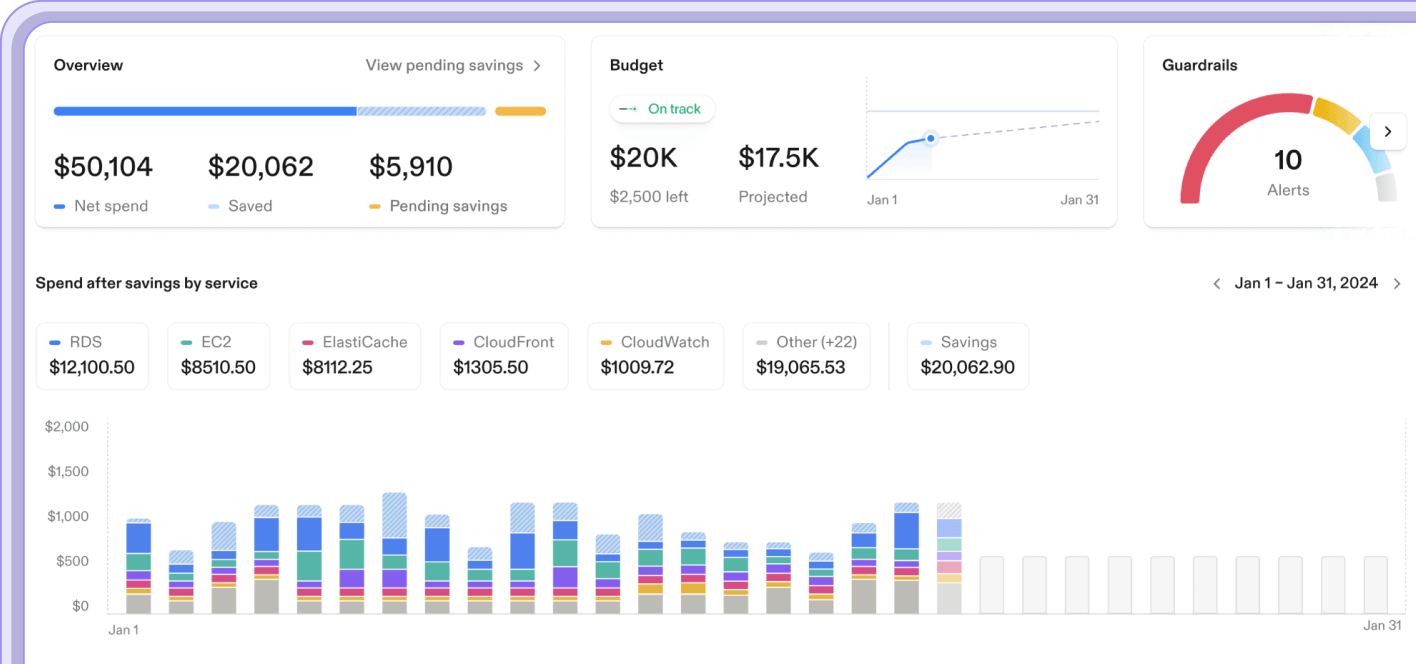

Eastnets Messaging Duplicate Detection

The collaboration with Eastnets had a big impact and produced significant results.

At the start, there were around 2% duplicate transactions. This led to over 50,000 duplicate transactions being found per institution. However, with our real-time duplicate detection capabilities, the tier-1 financial institutions achieved significant reductions, bringing the duplicate rate down to just fractions.

-

Enhanced reputation and trust

By preventing the risk of mistakenly sending duplicate payments, the financial institutions guarded their reputation and maintained the trust of their customers and partners

-

Cost savings

The implementation of Eastnets MessagingDuplicate Detection resulted in substantial cost reductions by avoiding fines and financial losses.

-

Operational efficiency and productivity

With real-time duplicate detection capabilities, streamlined payment, and automated handling of duplicates, the institutions saved valuable time and resources.

-

Enhanced fraud detection and prevention

By identifying and addressing potential fraudulent actions, the institutions strengthened their security measures and protected themselves and their customers.

-

Seamless correspondent relationships

The ability to promptly detect and return duplicates to correspondents fosters smooth and reliable interactions.

-

Compliance and regulatory adherence

By ensuring adherence to regulations, the institutions avoid penalties and maintain a robust compliance framework.

Results

Enhanced reputation and trust in the institutions.

Improved operational efficiency.

Products used

Messaging Duplicate Detection

Mais Yasen Product Manager at Eastnets

The ability to detect duplicates in real-time has revolutionised these financial institution’s operations and yielded remarkable improvements. Eastnets’ innovative solution has set a new standard for duplicate detection in the financial industry.

The next products in your Anti Money Laundering journey

Eastnets products are toolsets designed to work together for maximum protection and security. Stacking our products into a modular solution that fits your exact needs is highly recommended to reduce financial crime, fraud and other nefarious acts that could compromise your network.

Arrange a demo

Our fraud and compliance experts are ready to help build you a custom solution. Book a demo with our team today and start your journey to compliance bliss.