Industrial Bank of Korea Enhances AML Capabilities-Eastnets SafeWatch

- Resources

- Case studies

- Industrial Bank of Korea Enhances AML Capabilities-Eastnets SafeWatch

Situation

In today’s complex, ever-changing regulatory environment, where transactions happen faster and more often than ever before, implementing a flexible and realtime transaction screening solution is critical for every bank to maintain compliant and efficient operations.

About IBK

The Industrial Bank of Korea (IBK) is a nationwide bank headquartered in Seoul, South Korea. It provides comprehensive banking services to small and medium-sized businesses both domestically and internationally and has overseas branches and subsidiaries that serve customers in over 20 countries.

Challenges

Key Challenges

With a vast network of branches throughout Korea and worldwide operations, IBK used multiple screening and transaction monitoring systems to deal with a diverse array of regulatory requirements.

Management and monitoring of these systems were cumbersome and time-consuming, and having numerous systems led to high maintenance costs. What’s more, these systems were disparate, causing IBK’s compliance team to have reduced visibility into transactions across its operations and requiring compliance officers to perform manual compliance checks regularly.

With disparate screening systems that were inflexible and unable to provide a holistic view of operations, it was more challenging to efficiently manage, update, and respond to new regulatory obligations.

Solution

Eastnets action plan

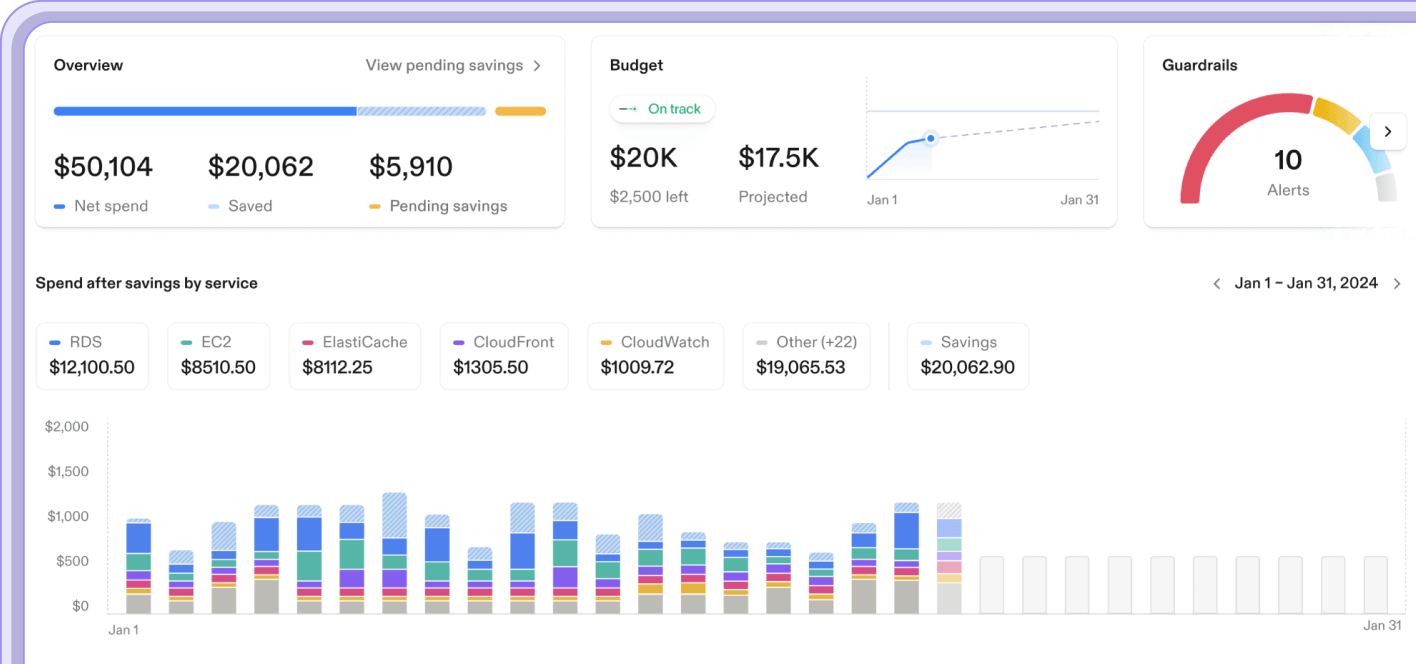

Eastnets provided IBK with SafeWatch Screening solution (SWS), a solution based on advanced technologies to provide fuzzy matching watchlist screening for realtime transactions, customer information batch mode capabilities, and other ad-hoc screening requirements.

SafeWatch Screening solution allows for continuous monitoring of customer and financial messaging. It provides a central checkpoint for financial and non-financial traffic, whatever the format or transportation of the data, and enables compliance officers to view all alerts from all sources on a single interface.

-

Improved screening performance

Using Eastnets’ SafeWatch Screening solution, IBK gained the capacity to easily configure filters to match their data requirements and align with the bank’s internal policy and risk appetite. The solution provided IBK access to high quality data sets from diverse watch lists and enabled significantly faster and more accurate real-time screening.

-

Greater flexibility & responsiveness

The solution’s flexibility delivered seamless versatility– ensuring IBK could stay up to date with the latest compliance regulations and recommendations in quicktime and without draining resources.

-

Increased visibility

As an advanced, integrated detection engine, SafeWatch Screening solution provided IBK with a centralized system to check all transactions, messages, and customers against diverse watch lists and manage and control screening across departments, branches, and jurisdictions.

Results

Improved screening performance

Greater flexibility & responsiveness

Products used

SafeWatch Screening

Mr. Chang, Seo Yuop IBK Bank Compliance IT Head

The next products in your Anti Money Laundering journey

Eastnets products are toolsets designed to work together for maximum protection and security. Stacking our products into a modular solution that fits your exact needs is highly recommended to reduce financial crime, fraud and other nefarious acts that could compromise your network.

Arrange a demo

Our fraud and compliance experts are ready to help build you a custom solution. Book a demo with our team today and start your journey to compliance bliss.